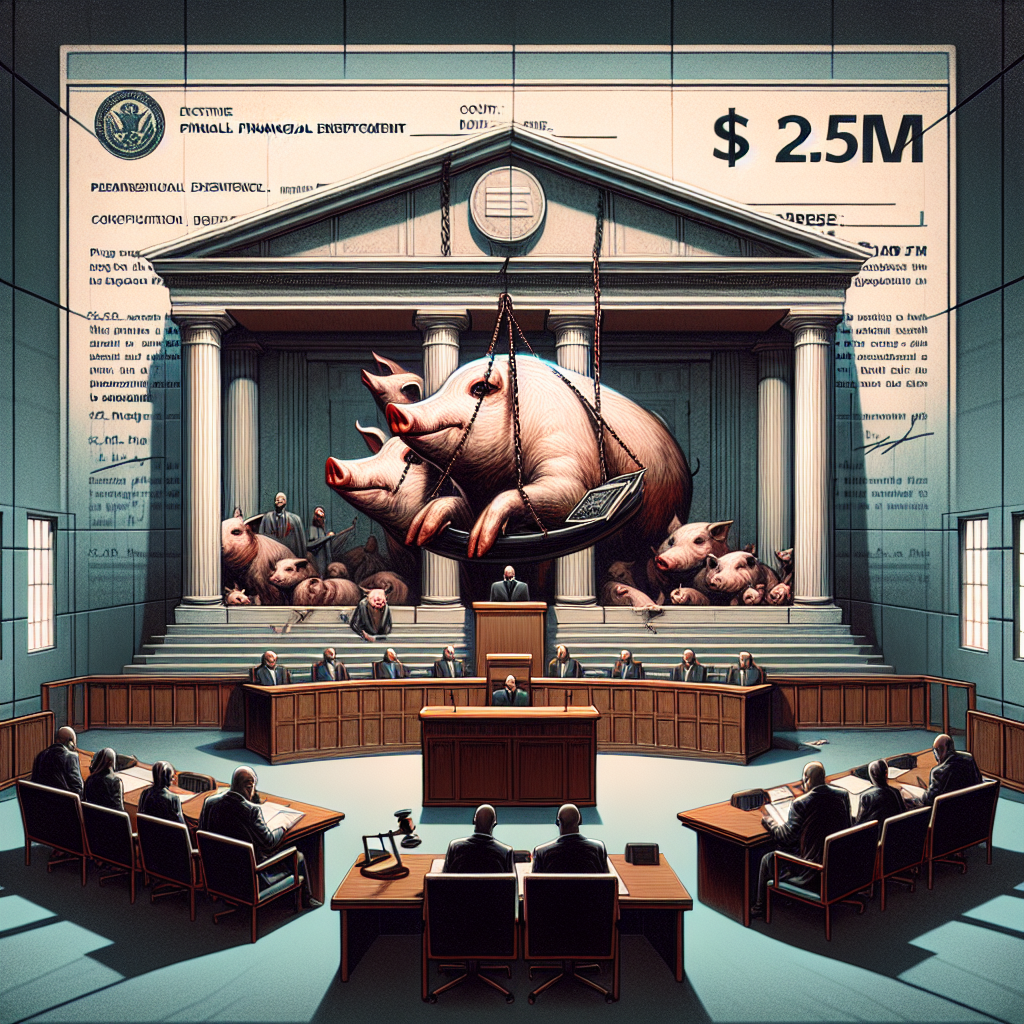

Debiex Ordered to Pay $2.5M in CFTC Pig Butchering Case

In a significant ruling that underscores the ongoing battle against cryptocurrency fraud, the Commodity Futures Trading Commission (CFTC) recently secured a monumental victory against the crypto platform Debiex. The commission ordered Debiex to pay $2.5 million for its involvement in a notorious scheme commonly referred to as “pig butchering,” a term used to describe a specific type of investment scam that preys on unsuspecting individuals by promising substantial returns on investments.

Understanding Pig Butchering: The New Face of Fraud in Cryptocurrency

Pig butchering scams represent one of the most insidious forms of fraud in the cryptocurrency space. The term describes a process whereby fraudsters build relationships with victims over time, gradually convincing them to invest significant sums of money into non-existent or completely worthless financial schemes. This long con often exploits the victim’s trust, leading to devastating financial losses.

How the Scheme Works

Typically, a pig butchering scam unfolds in several stages:

The CFTC’s Action Against Debiex

The CFTC’s case against Debiex highlights its commitment to protect investors and combat rising fraudulent activities within the crypto industry. The order against Debiex is centered around numerous complaints from individuals who found themselves ensnared in its fraudulent schemes.

Key points from the CFTC’s ruling include:

The $2.5 million penalty imposed on Debiex is a clear message from the CFTC that such deceptive practices will not be tolerated. This ruling not only penalizes Debiex for its actions but also serves as a deterrent to other platforms that might engage in similar activities.

The Broader Implications for the Crypto Industry

The CFTC’s decisive action against Debiex holds significant implications for the broader cryptocurrency landscape. As digital assets continue to gain recognition, the potential for fraud rises in tandem. Regulatory bodies are increasingly focusing their efforts on ensuring that investors are protected from deceptive practices.

The implications of this ruling may include:

Preventing Future Scams: What Investors Need to Know

As the crypto landscape continues to evolve, potential investors must be educated about the risks and red flags associated with investment scams. Here are some crucial tips to consider:

Stay Informed

Keeping abreast of news regarding crypto regulations and frequently updated scam reports can help investors avoid falling victim to fraud.

Utilizing Resources

Investors should leverage available resources, such as educational programs and community forums that focus on cryptocurrency awareness and best practices. Engaging with communities that prioritize integrity and shared knowledge can also help protect against scams.

Conclusion: A Call for Vigilance in the Cryptocurrency Landscape

The recent ruling against Debiex by the CFTC is a pivotal moment in the ongoing fight against cryptocurrency fraud. As scams like pig butchering become more prevalent, it is imperative for investors to exercise diligence and caution. Regulatory bodies are stepping up their enforcement actions, but individual awareness and education are equally crucial in navigating this increasingly complex financial landscape.

By understanding the methods employed by scammers and taking proactive measures to protect themselves, investors can help shield themselves from the devastating impacts of fraud. As the cryptocurrency industry continues to evolve, both investors and regulators must remain vigilant to foster a safer and more secure environment for all participants.

The CFTC’s victory against Debiex serves as both a warning and a hope—an assertion that justice can prevail in the crypto space while underscoring the necessity for continued vigilance and education within the investing community.