KYC Integration on Uniswap: PureFi Faces Mixed Reactions

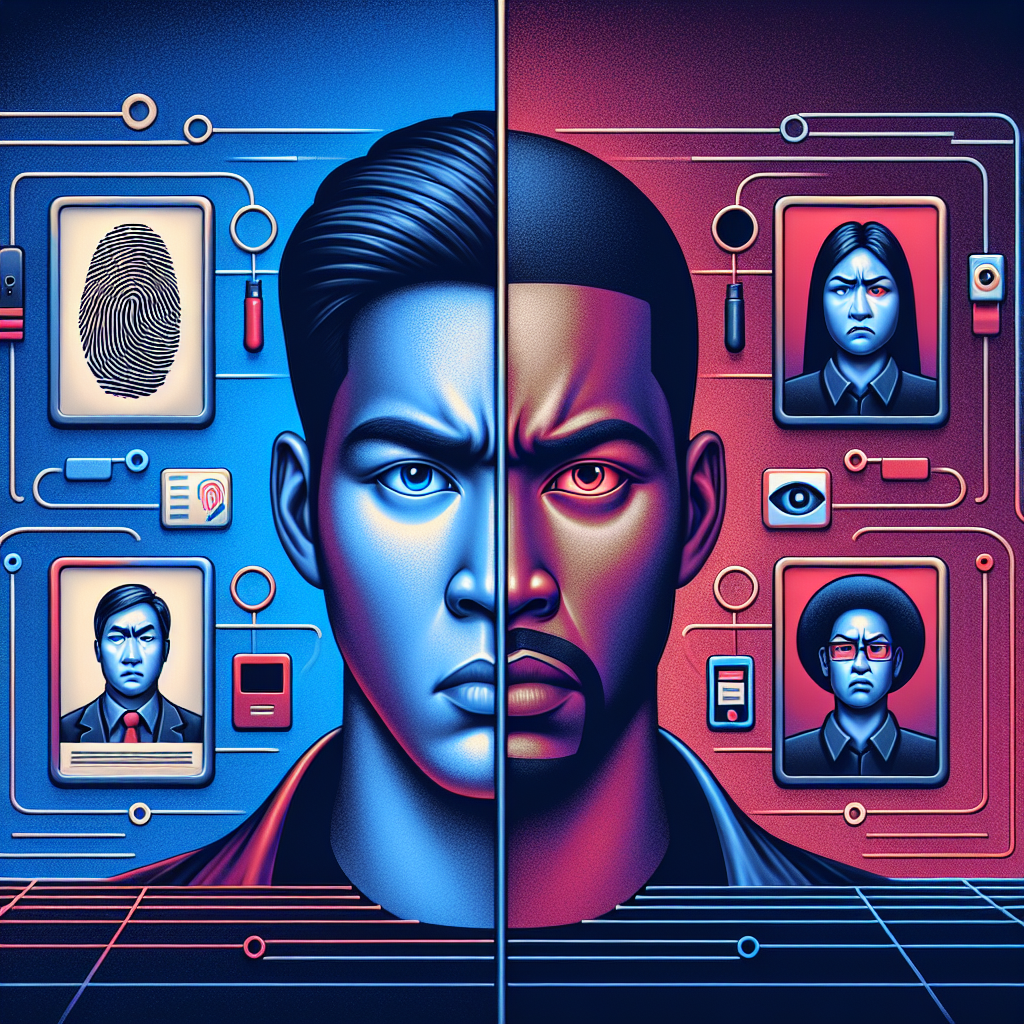

The cryptocurrency landscape is evolving rapidly, and with this evolution comes the increasing importance of compliance measures, such as Know Your Customer (KYC) protocols. Recently, PureFi has announced an integration of KYC services on the decentralized exchange Uniswap, stirring up a diverse array of reactions from the crypto community. While some see this move as a necessary step towards legitimacy and enhanced security, others raise concerns about privacy and the foundational principles of decentralization.

The KYC Integration Explained

KYC involves verifying the identity of customers to prevent fraud, money laundering, and other illegal activities. By implementing KYC on Uniswap, PureFi aims to address regulatory requirements while enabling users to engage in compliant trading practices. But what exactly does this integration entail?

Key Features of the PureFi-KYC Integration:

- Verification of user identities to ensure compliance with financial regulations.

- Integration with Uniswap allows for seamless trading experience after KYC completion.

- Enhanced security measures to protect against illicit activities.

This integration represents a significant shift in how decentralized exchanges (DEXs) operate. Traditionally, DEXs like Uniswap have allowed users to trade assets without the need for personal information, offering a higher degree of privacy. PureFi’s KYC integration may challenge this foundational ethos.

Community Reactions: Support and Dissent

PureFi’s announcement has sparked a split reaction across the crypto community.

Supportive Voices

Proponents of the KYC integration argue that the adoption of compliance protocols is essential for the growth and acceptance of the cryptocurrency market. They believe that KYC can help:

- Enhance the legitimacy of decentralized exchanges.

- Attract institutional investments by demonstrating adherence to regulatory standards.

- Fortify security measures, thereby mitigating fraudulent activities.

For many, this is a crucial step towards a more regulated environment that could attract both retail and institutional investors. In an era where governments are increasing scrutiny of cryptocurrencies, KYC may be the key to maintaining operational freedom while complying with legal obligations.

Criticism from the Community

Conversely, critics argue that the integration of KYC undermines the very foundation of decentralized finance (DeFi). They raise several points of concern, including:

- Loss of Anonymity: Many users value the anonymity that decentralized exchanges offer, which KYC requirements would infringe upon.

- Centralization of Power: Critics argue that any integration that requires user data leans towards centralization, which is contrary to the principles of DeFi.

- Regulatory Overreach: Some fear that KYC integration could lead to excessive regulatory oversight, stifling innovation in the space.

A vocal segment of the crypto community believes these changes could pave the way for a future where decentralized exchanges lose their autonomy, succumbing to the expectations of centralized financial systems.

The Future of KYC in DeFi

The introduction of KYC in DeFi, particularly through a major platform like Uniswap, raises important questions about the future of decentralized finance. As regulatory bodies worldwide tighten their grip on cryptocurrencies, there is immense pressure on DEXs to adopt compliance measures.

Potential Scenarios for KYC in DeFi:

1. **Mainstream Adoption**: If successful, PureFi’s integration could become a blueprint for other exchanges, paving the way for broader acceptance of KYC protocols in DeFi.

2. **Implementation of Alternatives**: To balance privacy and compliance, we may see the rise of alternative methods such as zero-knowledge proofs that allow for validation without revealing user identities.

3. **Community Rejection**: A backlash against KYC requirements could lead to the establishment of completely anonymous DEXs that resist regulatory integration altogether, striving to maintain the ethos of decentralization.

Conclusion: Navigating the Future of DeFi

As the cryptocurrency ecosystem continues to mature, the tension between security and privacy will persist. PureFi’s KYC integration on Uniswap marks a critical juncture in the evolution of decentralized exchanges. While it introduces essential compliance measures that could enhance the market’s credibility and security, it also challenges the foundational principles of privacy and decentralization that many users hold dear.

The true impact of this integration will be revealed in the coming months as more users weigh the benefits against their concerns and as regulatory environments around the world continue to evolve. In this ever-changing landscape, the dialogue surrounding KYC and DeFi is not just about technology; it’s about the values that define our financial future.

It remains to be seen whether the industry will move towards a more compliant framework or continue to advocate for the core ideals of anonymity, decentralization, and user autonomy. Only time will tell how PureFi’s KYC integration will influence the broader crypto space, but one thing is clear: the conversation is just beginning.

In this dynamic environment, participants in the crypto world must remain vigilant, informed, and engaged, as the outcome of these developments could shape the future of decentralized finance as we know it.