US Customs Confuses Bitcoin Miners for Radio Devices

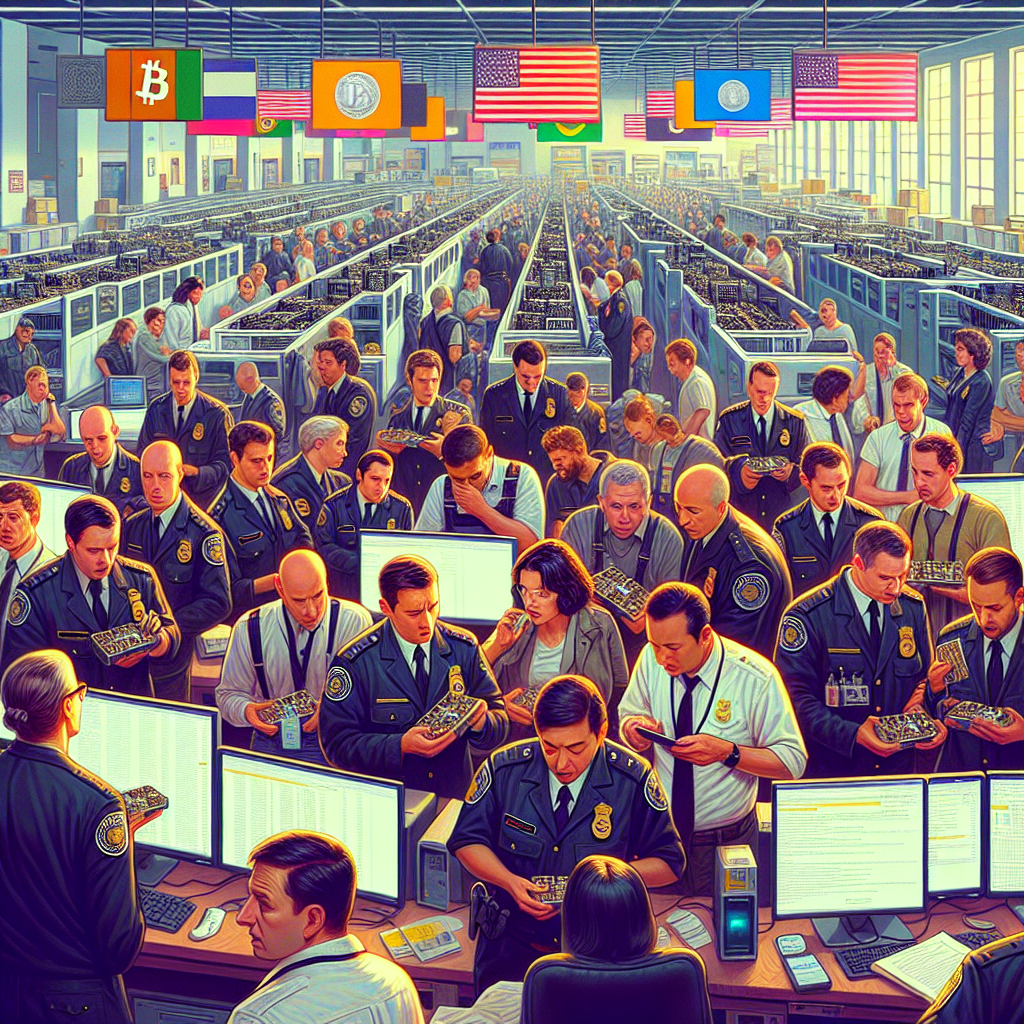

In a bizarre turn of events, U.S. Customs and Border Protection (CBP) recently made headlines when it mistakenly identified Bitcoin miners as radio frequency devices. This incident not only highlights the prevalent misconceptions surrounding cryptocurrency mining but also raises questions about the officials’ grasp of emerging technologies. In this article, we will delve deeper into this unusual mix-up, its implications, and the broader context of cryptocurrency regulation.

The Mix-Up: What Happened?

The incident first came to light when CBP officials in Cincinnati seized over $1 million worth of Bitcoin mining hardware. Initially, officials assumed that these miners were unauthorized radio frequency devices. This confusion is understandable, given the rather technical nature of various devices being shipped internationally.

The Bitcoin miners in question are essential machines that validate transactions on the Bitcoin network, a process that involves solving complex mathematical problems. These machines, while they may exhibit some tech elements akin to radio devices, are specifically designed for conducting cryptocurrency mining operations.

Why the Confusion?

The misunderstanding between Bitcoin miners and radio frequency devices raises critical questions about recognition and understanding of technology by regulatory bodies. Some possible reasons for the mix-up include:

This instance underscores the ongoing battle between advancing technology and the regulatory landscape that often struggles to keep pace.

The Implications of Misclassification

The implications of this incident extend well beyond a simple case of mistaken identity. In fact, the ramifications touch several aspects, including industry trust, regulation, and consumers’ understanding of cryptocurrencies.

Impact on Industry Trust

When government agencies misidentify essential equipment within a burgeoning industry, it can lead to:

Regulatory Challenges

The incident demonstrates the larger regulatory hurdles that cryptocurrency-related companies face. Governments worldwide are grappling with how to approach taxation, legality, and conformity for such a dynamic sector. This blend of confusion may lead to untimely and ill-informed policies.

As Bitcoin and other cryptocurrencies continue to grow in both popularity and complexity, it’s essential to see more proactive measures in educating regulatory bodies about this technology. This confusion over Bitcoin miners signals a need for improved training and resources within CPB and similar organizations around the world.

The Road Forward: Solutions to Avoid Future Mistakes

Given the evolution of technologies such as cryptocurrencies, regulators must take deliberate steps to better equip themselves for the future. Here are some potential solutions to avoid misunderstandings like this one in the future:

By implementing these solutions, stakeholders can work together to ensure that regulatory environments evolve alongside technological advancements.

The Bigger Picture: The Evolution of Cryptocurrency Regulation

As cryptocurrencies continue to penetrate global markets, issues like misclassification will likely surface more frequently if not addressed proactively.

Global Regulation Trends

Several countries have begun working toward standardized regulations concerning cryptocurrency mining:

These evolving regulations highlight the importance of ensuring clarity in definitions across jurisdictions to avoid similar mishaps like the recent mix-up with crypto miners.

Conclusion

The incident in which U.S. Customs misidentified Bitcoin miners as radio devices serves as a wake-up call to regulatory agencies to better understand emerging technologies. As the cryptocurrency industry continues its growth trajectory, an informed regulatory framework becomes vital, ensuring that innovative technologies are correctly classified and understood. As we navigate this digital future, collaboration between regulators, industry experts, and consumers will be the key to fostering a secure and thriving cryptocurrency ecosystem.

Understanding these complex technologies is not just about avoiding future mistakes; it’s about crafting a coherent and supportive environment for all participants in this rapidly evolving market. Embracing education and collaboration will ultimately lead to better regulations that both protect consumers and support innovation in the cryptocurrency space.